The result above is generic and based on simple assumptions. By hitting "Improve result", you will be invited to make the tax simulation yours and get results based on your actual situation.

Self-employment offers flexibility, such as choosing your projects and work hours, but it also brings unique tax and financial challenges. Unlike employees, the self-employed must manage their income, expenses, and taxes independently, ensuring they submit invoices, claim eligible business expenses, and complete tax returns on time. Taxes include income tax, VAT, and possibly trade tax (Gewerbesteuer), depending on the profession. This means you need to save part of your earnings for tax payments, as self-employed individuals are responsible for their tax declarations.

You have to make sure to properly manage your taxes and contributions, as incorrect calculations can lead to unexpected back taxes. Another major consideration is social contributions: unlike employees, self-employed individuals must arrange their own health insurance and retirement provisions.

You’re probably asking yourself, how much should I set aside for taxes? What amount should you reserve for income tax, VAT, etc.? We created this Gross Net Tax Calculator to help self-employed individuals and those who are thinking to become self-employed to estimate their post-tax income and keep an overview of their finances. Here you’ll learn how the Gross Net Tax Calculator works, which factors affect net income, and tips for long-term financial security.

For new freelancers, it’s often challenging to determine how much to save from their income for taxes. Because exact tax payments vary and cannot be estimated universally. Every income-earning individual in Germany is required to pay taxes to the tax office. Self-employed individuals generally must pay income tax and VAT unless they qualify for the small business regulation (Kleinunternehmer), which can waive VAT in the first year, offering financial advantages. Those with registered businesses (Gewerbe) must also account for trade tax.

Income tax applies to all profits you earn, with rates reaching up to 42%. Accurate reporting of all business expenses on your tax return helps reduce your tax liability. The current allowance for single self-employed individuals is €11,604, meaning only earnings above this threshold are taxable. For example, with a profit of €25,000, income tax only applies to the portion exceeding the allowance.

In the early years, income tax is determined retrospectively with the tax return; later, quarterly advance payments are required based on estimated income.

To better understand how much to save for income tax, you can use our tax calculator or check Accountable’s free app, where you can track tax payments and required savings. The app simplifies tax preparation and helps manage your finances.

Previously, an additional 5.5% solidarity surcharge was due, but following reforms in 2020, only high earners now pay it.

Registered businesses (Gewerbe) also incur trade tax, with rates varying by municipality. However, there’s also a nationwide allowance of €24,500. Exceeding this yearly limit requires you to save for trade tax, while those below are exempt and only need to submit the trade tax return (Gewerbesteuererklärung).

Self-employed individuals typically charge VAT on their goods or services and remit it to the tax office (Finanzamt). Rates are usually 19%, or 7% for reduced-rate items. One advantage of VAT is the ability to reclaim VAT on business expenses from the tax office.

Small businesses earning less than €22,000 in the first year can apply for VAT exemption. You must request this exemption when registering and note it on invoices, it’s called ‘Kleinunternehmerregelung’.

Tax planning can be challenging in the first year, with many payments due retroactively, so plan well to stay financially secure and factor in advance payments for the following year. Use tools like Accountable’s app to track your earnings and expenses and enhance your financial planning.

➡️ Learn more about how much money to set aside as a self-employed person for taxes.

Gross net calculators, like the one by Accountable, offer self-employed individuals a clear financial overview. By entering gross income, expenses, and tax categories, you’ll receive a detailed net income calculation. To use the calculator, simply:

💡 Example calculation for small business or side hustle

Hourly rate: €25

Weekly hours: 15 hours

Work weeks per year: 40 weeks

Annual revenue: €25 x 15 hours x 40 weeks = €15,000

💡 Example calculation for full-time self-employment

Daily rate: €300

Billable days per year: 200 days

Annual revenue: €300 x 200 days = €60,000

Long-term financial planning is crucial for self-employed individuals. Savings for taxes, reliable retirement provisions, and coverage for health emergencies ensure financial stability. With a net income calculator, monthly savings planning becomes easier. Consider Rürup pension plans, which offer tax benefits tailored to self-employed individuals for long-term financial security. Here are some tips to stay secure in the long run:

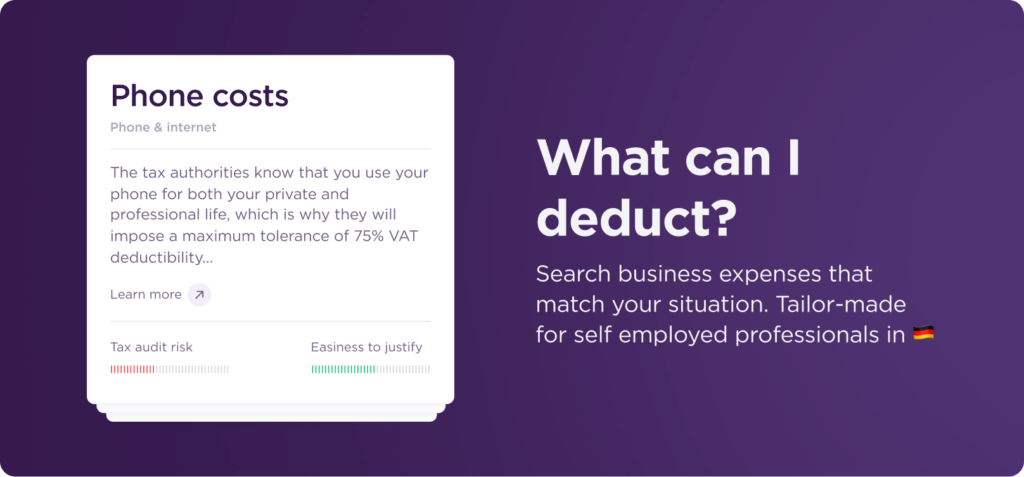

Don’t overlook the importance of deducting as many expenses as possible. Regularly reviewing your business expenses is highly beneficial. Even small, everyday expenses like professional books, training costs, or office supplies add up quickly and can be deducted as business expenses. Using digital accounting software simplifies this process, letting you categorize expenses and track finances effortlessly. Documenting every business cost maximizes your tax savings and streamlines your accounting. Regular reviews help you identify unnecessary expenses and use your budget efficiently, enhancing financial security and simplifying your annual tax return.

As a self-employed person, you bear full responsibility for your financial security, making certain insurances essential. Beyond mandatory health and long-term care insurance, consider disability insurance to protect against income loss due to illness or accident. Business liability insurance is also important, as it covers damages caused by you or your services. Regularly assess your insurance needs for comprehensive protection.

➡️ Read more about essential insurance for the self-employed here.

We designed the Gross-to-Net Calculator at Accountable specifically for self-employed professionals, offering a quick and easy overview of income, expenses, and tax liabilities. Get started for free.

💡 Want to manage your taxes and accounting in one platform? Accountable provides everything you need to succeed in your self-employed journey. Accountable is the tax software for freelancers, entrepreneurs, and small business owners. It enables you to submit all tax returns to the tax office, manage daily accounting, and receive AI and tax coach support. Try it now!

Why should I use Accountable’s Gross-to-Net Calculator?

As a self-employed professional, managing finances can be complex, with business expenses, taxes, and insurance to track. Accountable’s Gross-to-Net Calculator helps simplify things, giving you a clear view of your net income in just a few steps, enabling better financial planning for your income, expenses, and savings.

The tool is quick, free, and easy to use. With just a few inputs, you get a precise net income overview—securely, anonymously, and with zero hidden costs or required registration.

What does the Gross-to-Net Calculator show?

After entering your details, the calculator displays:

How can I calculate my income tax as a self-employed professional?

Your income tax depends on annual profit. The Gross-to-Net Calculator provides an estimate based on your inputs for income, expenses, and any applicable deductions, making it easy to see the taxes owed and plan for what’s left.

Which additional deductions should I consider as self-employed?

Beyond income tax, self-employed individuals may need to account for health, long-term care, and possibly retirement insurance, as well as VAT, if applicable. The calculator organizes these deductions clearly to help you budget for all obligations.

When will I need to make advance payments?

Typically, after your first business year, quarterly income tax prepayments are due, based on previous year’s income. The Gross-to-Net Calculator aids in planning for these prepayments to avoid financial surprises.

The Accountable Net Income Calculator is ideal for self-employed professionals seeking clarity on their income and deductions. Try it now and gain a valuable financial planning overview. Get Started!