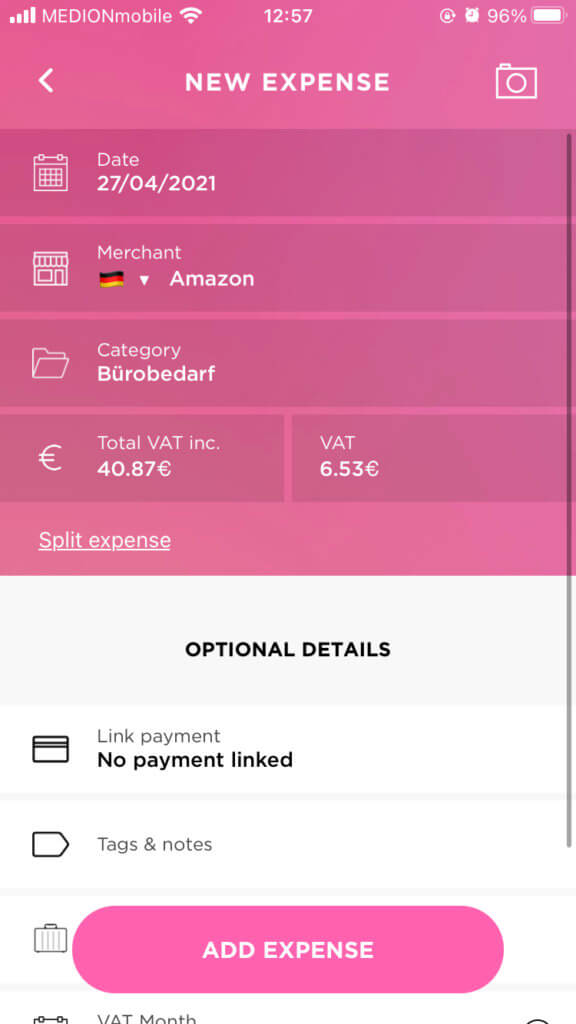

Create new expense

Create new expense

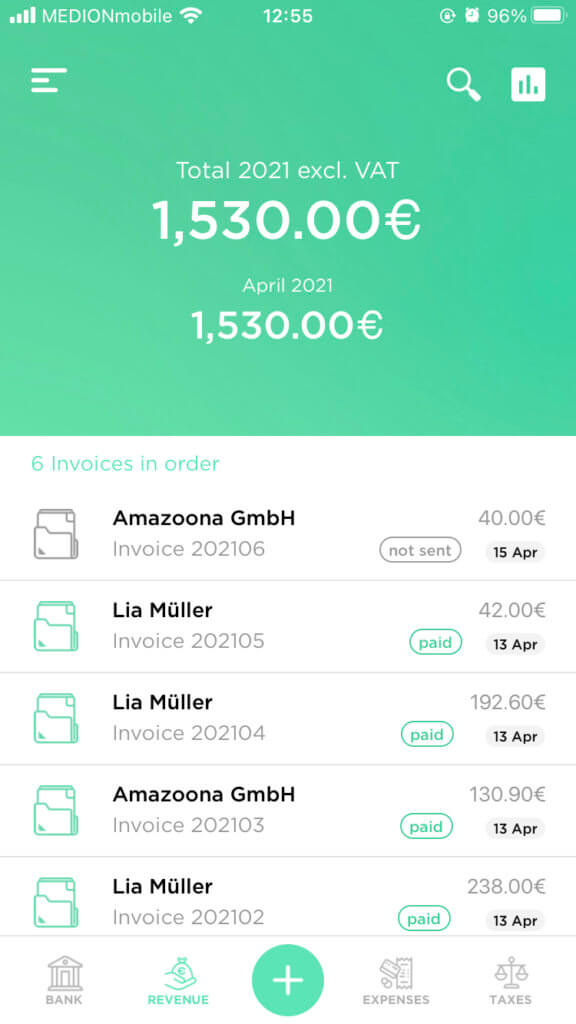

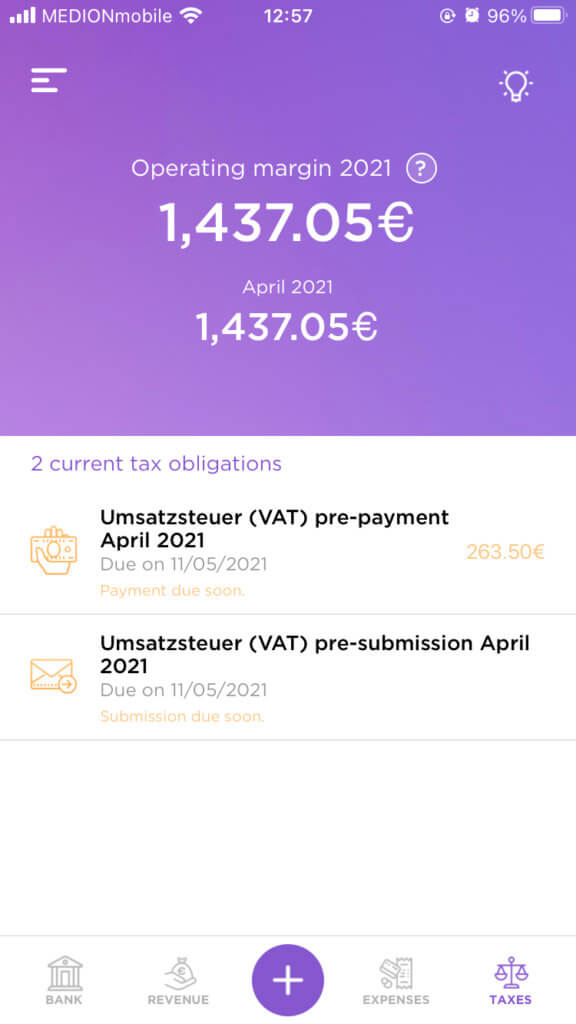

The amount of VAT you have to pay in advance is calculated from the income and relevant business expenses you've entered in the Accountable app.

The amount of VAT you have to pay in advance is calculated from the income and relevant business expenses you've entered in the Accountable app.

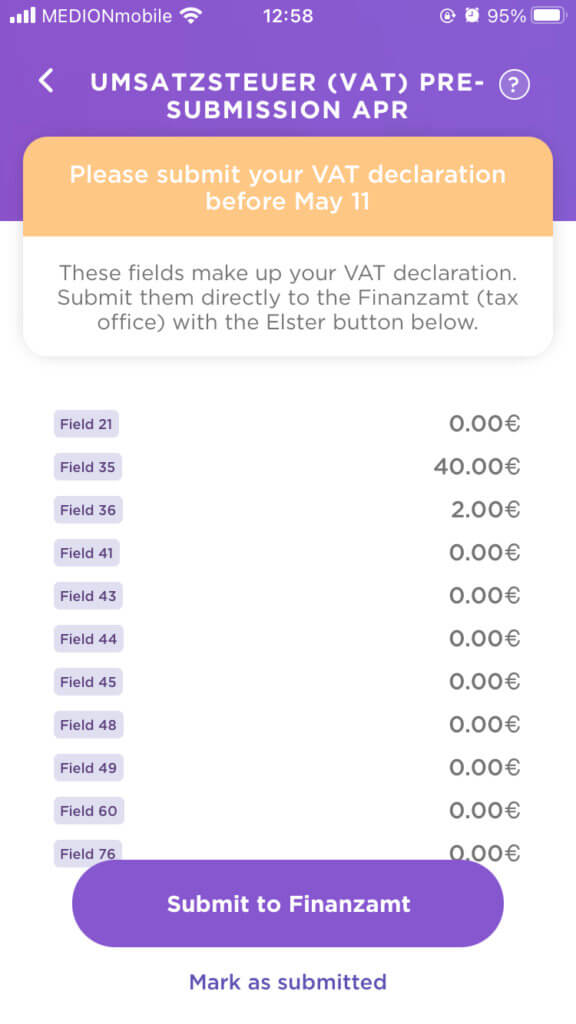

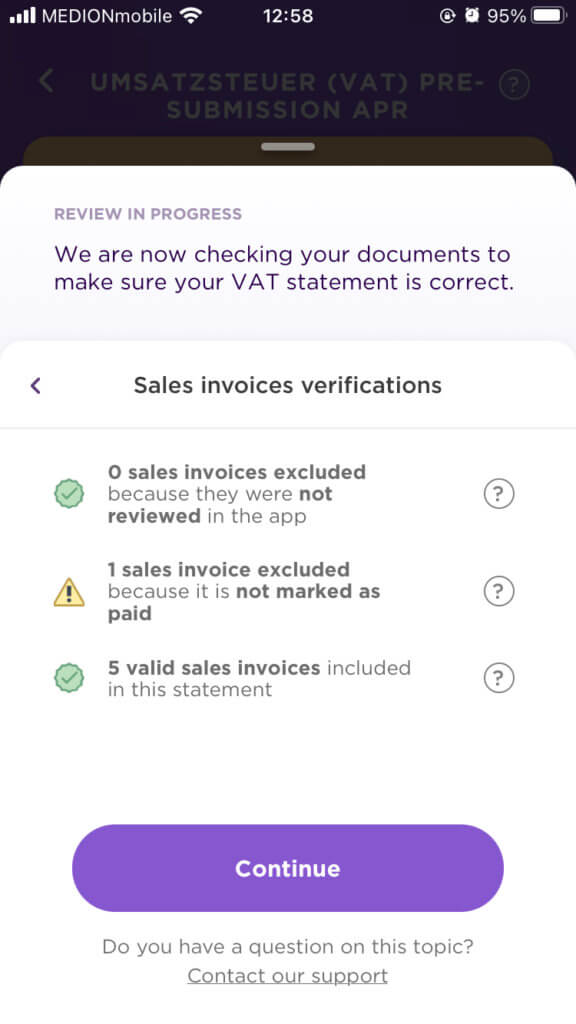

By clicking on the corresponding VAT return, you will find an overview of the relevant details, which Accountable submits directly to your Finanzamt via ELSTER. Click on "Send to tax office" to have your data checked once again.

By clicking on the corresponding VAT return, you will find an overview of the relevant details, which Accountable submits directly to your Finanzamt via ELSTER. Click on "Send to tax office" to have your data checked once again.

As soon as you've checked and verified the information, you can send your VAT return directly to your Finanzamt. A copy of the transfer is automatically sent to your email address.

As soon as you've checked and verified the information, you can send your VAT return directly to your Finanzamt. A copy of the transfer is automatically sent to your email address.

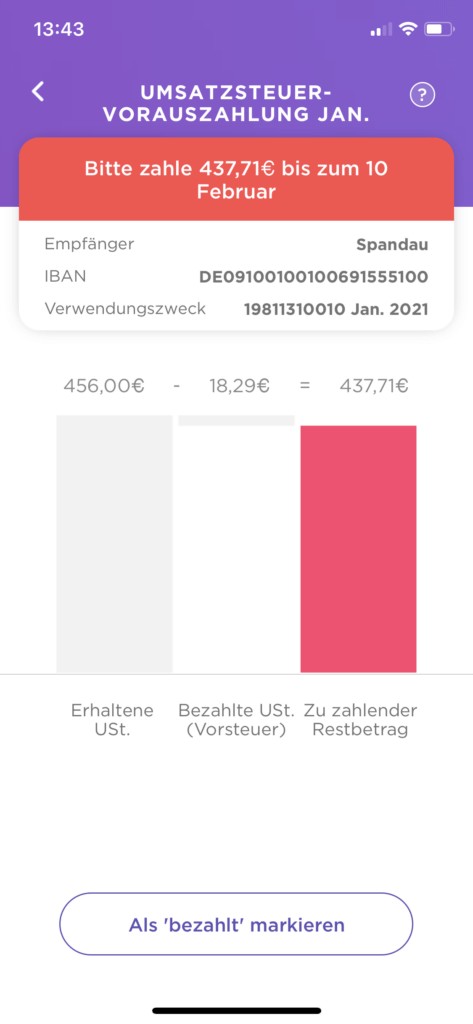

The last step for you is to transfer the VAT amount owed to your local Finanzamt. Accountable automatically calculates the amount for you, and also shows you the account details of your Finanzamt. How easy is that?

As soon as you have transferred the money, you can mark the VAT return for the relevant month as paid and fully concentrate on your work again!

The last step for you is to transfer the VAT amount owed to your local Finanzamt. Accountable automatically calculates the amount for you, and also shows you the account details of your Finanzamt. How easy is that?

As soon as you have transferred the money, you can mark the VAT return for the relevant month as paid and fully concentrate on your work again!

20 Kapitel knallhart recherchiert und vom Steuerprofi geprüft

Kostenlos herunterladen

Author - Sophia Merzbach

Sophia has been a key member of the Accountable team for many years, bringing a unique blend of journalistic precision and in-depth tax expertise to her work.

Who is Sophia ?Thank you for your feedback!

Useful

How much income tax is deducted from your income is largely determined by your tax class. There are ...

Read moreWorking as a self-employed professional has many advantages: You are your own boss and you can choos...

Read moreWorking with international clients can be tricky, depending on where exactly they’re located, whet...

Read more