Understanding the Finanzamt – The Steuernummer letter

Read in 4 minutes

You’ve got mail – by the Finanzamt!? No worries, after you registered as self-employed with the “Fragebogen zur steuerlichen Erfassung” you will get a letter with your Steuernummer (tax number) after about three weeks. In this article, we explain what information you can take from this letter step by step.

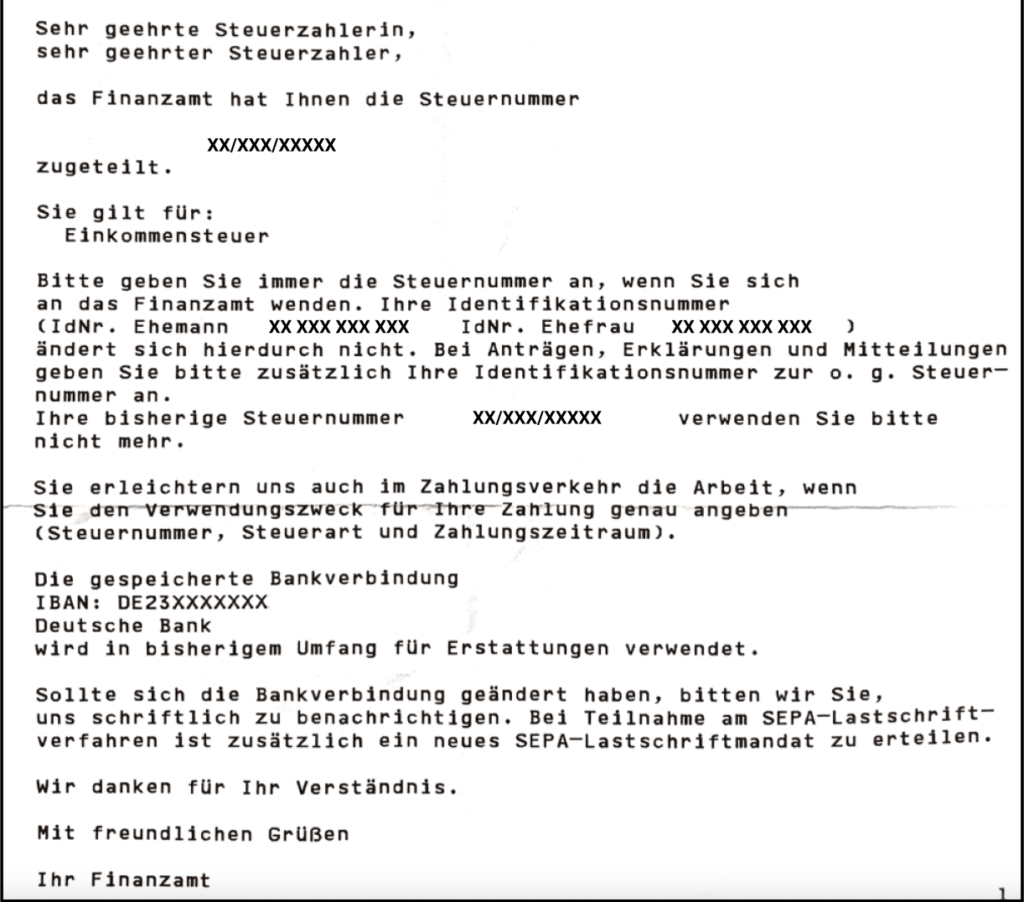

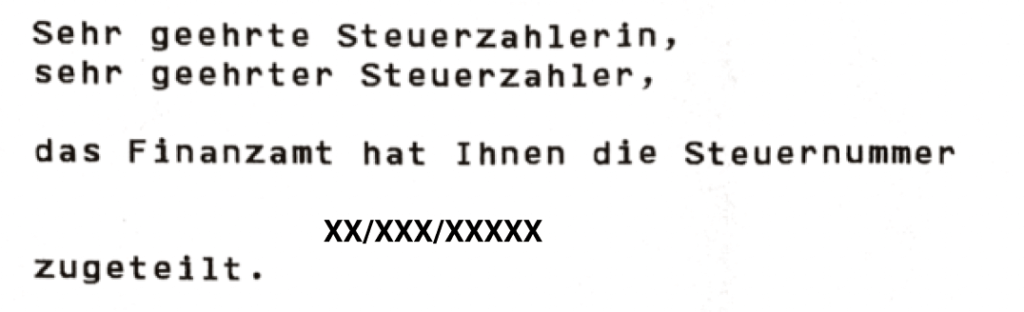

1. Your new Steuernummer

The beginning of the letter actually is quite plain and simple. It states your new Steuernummer. This number is the one you were waiting for, because now you can start sending official invoices to your clients.

Tip from Accountable 💡: You got your Steuernummer, but you are new to writing invoices in Germany? Read how to get it right, here. You will see, it’s not too complicated after all.

2. These are your tax obligations

Next up, you can read what your tax obligations will be as a self-employed person. In most cases it will be the following, but it depends on your specific case. It’s possible that you are required to submit all, or some of these:

- Einkommensteuer -> your general income tax return once a year

- Umsatzsteuer -> your VAT either monthly, quarterly or yearly

- Gewinnermittlung nach § 4 Abs. 3 EStG -> your profit and loss statement (EÜR) which is a simplified way of calculating your profit. You submit it together with your income tax

3. Your official job title registered at the Finanzamt

The next information you might find is the official job title that you are registered with at the Finanzamt now. Usually, this description is what you stated in the job description in the “Fragebogen zur steuerlichen Erfassung”. But it’s not always stated on the letter again.

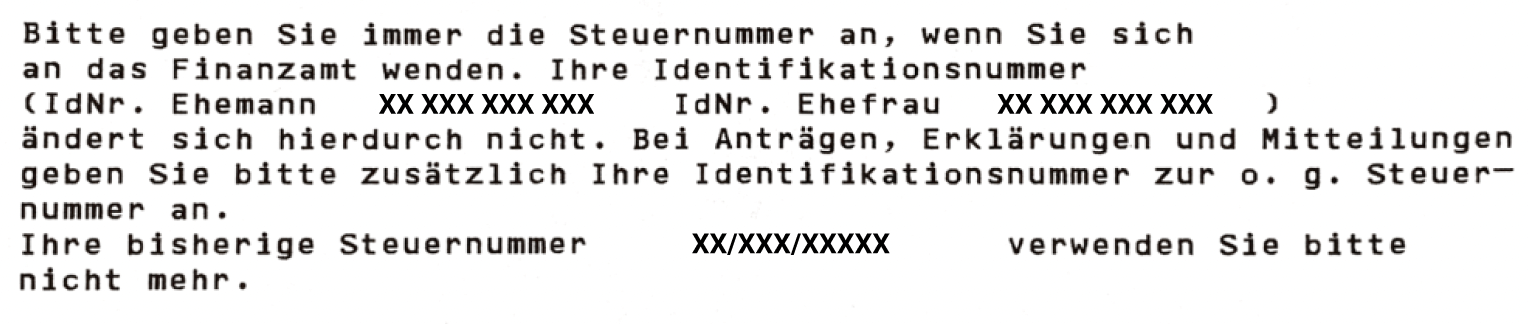

4. Reminder – that’s your Steueridentifikationsnummer

The letter also tells you your Steueridentifikationsnummer (tax ID number) again. It’s your personal identification number and it will not change. It’s just stated in this letter again, because whenever you want to contact your Finanzamt you need to give your Steueridentifikationsnummer and Steuernummer. This way, the Finanzamt can identify you correctly. If you are married, you also find your spouses number there.

5. When to submit your VAT return

The next part is quite important, because here you find information about when you need to submit your VAT return. The period is either monthly or quarterly. So pay attention here, to make sure you submit your VAT correctly.

If you registered as Kleinunternehmer, you won’t find this paragraph in the letter, as you only need to prepare your VAT once a year together with your income tax.

Tip from Accountable💡: You can submit your VAT directly in the Accountable app to your Finanzamt. You find the option here. It even shows you how much you need to pay.

6. How to pay the Finanzamt

The last paragraph just informs you about the possible ways to pay your taxes. Whenever you pay, you should state your Steuernummer, which type of taxes and the time period you are paying for. You can also agree to the SEPA Lastschriftverfahren (direct debit payment) with an extra form that you find on the website of your Finanzamt.

Tip from Accountable 💡: When you are married, it’s possible that you get two letters by the Finanzamt with two separat Steuernummern. In this case, you have one number for your VAT and EÜR and one number for the income tax that you submit together with your partner.

How do I contact the Finanzamt?

After you received this letter, you don’t need to do anything more for the Finanzamt for now. You have everything you need in order to start working officially as a freelancer. The next obligation will be the VAT return, if you are not a Kleinunternehmer.

If you still want to contact the Finanzamt, you can either call directly or fill in an official form provided on your local Finanzamt’s website. For example here for the Finanzamt Berlin, here for Finanzamt Munich and Bavaria or here you find contact details for the Finanzämter in North Rhine-Westphalia.

Did you find what you were looking for?

Happy to hear!

Stay in the know! Leave your email to get notified about updates and our latest tips for freelancers like you.

We’re sorry to hear that.

Can you specify why this article wasn’t helpful for you?

Thank you for your response. 💜

We value your feedback and will use it to optimise our content.