After you registered as self-employed in Germany, you will get several letters by the Finanzamt. One of them will be about your prepayments that you'll need to pay throughout the year. In this article, we explain what information you can take from this letter step by step.

You received this letter with a big table and lots of numbers but aren't sure, what this actually is? Here, the Finanzamt informs you about your tax prepayments.

The state wants to ensure that all self-employed professionals regularly pay taxes on their income. So you as taxpayer are prevented from having to pay the tax burden all at once at the end of the year. For this reason, the state levies regular prepayments. The amount is decided according to your expected annual income and is due in a quarterly (or monthly) rhythm.

Right on top you find the important information for which taxes you actually need to do prepayments:

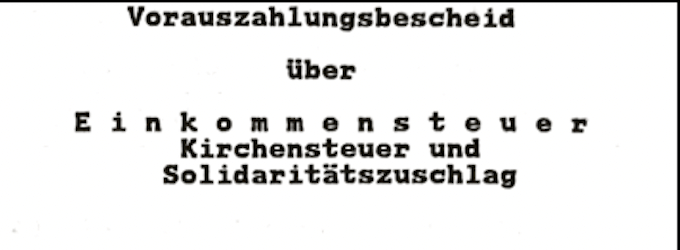

Next, you'll see when you need to make such payments and how much you actually need to pay. It's in form of a table where you see the three different taxes on the left and the period they are due above. It tells you, how much you need to pay and what the deadlines are for those prepayments.

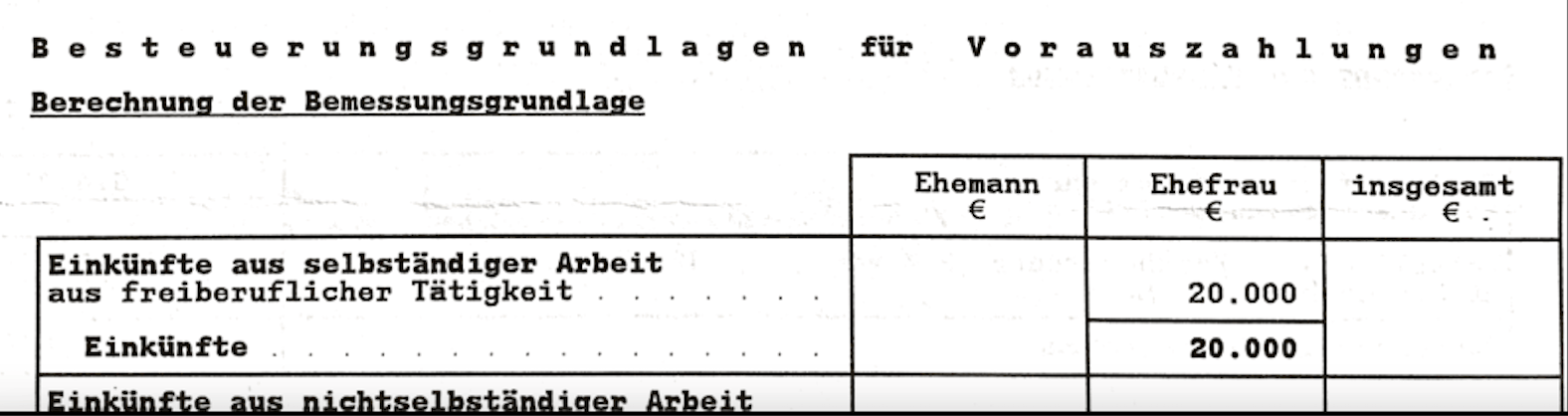

The last part shows you, on what the amounts for the prepayments are based on. The Finanzamt determines them on what you earned in the previous year or, if you just started as a freelancer, on the estimate of your yearly income that you provided in the registration form. It might look similar to this.

You see, the letters that the Finanzamt sends you look kind of scary and complicated at first, but once you understand them, they hold a lot of important information about your start as a self-employed person.

Tip from Accountable💡: It's always possible that you miss a deadline and forget to pay. In this case, you will get a letter with a reminder, or Mahnung. Make sure to respond to such a letter with paying the amount due right away. Worried about getting in trouble with the Finanzamt? Read here, what happens if you miss a deadline.

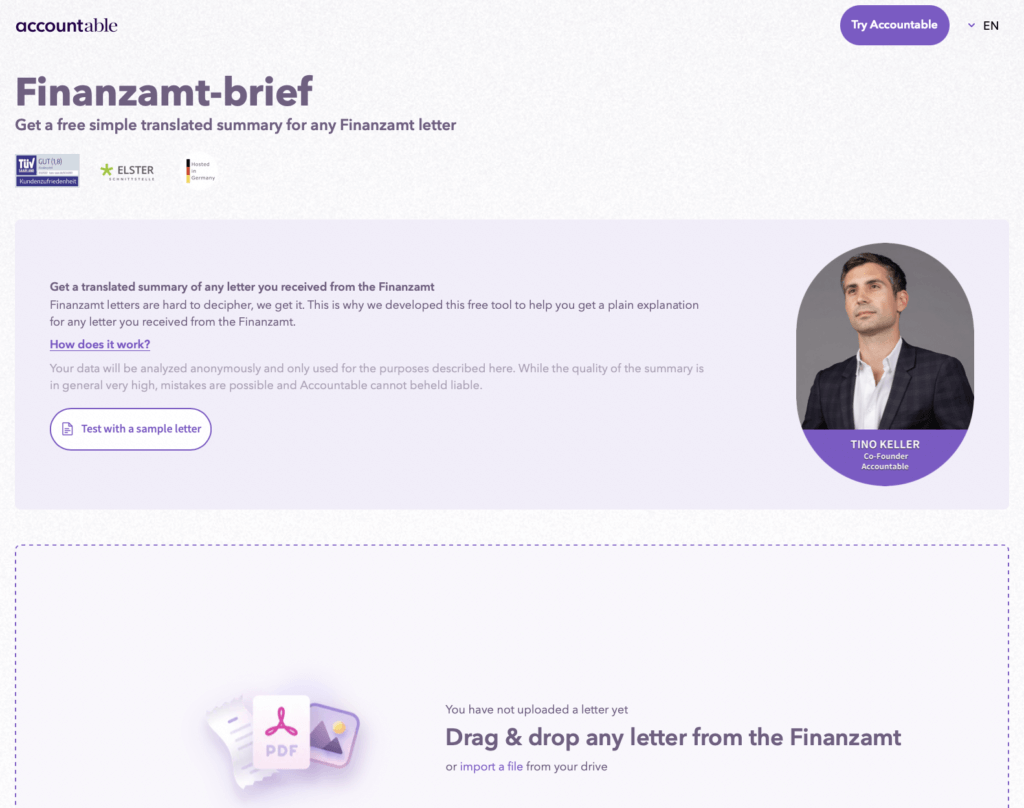

Use our free AI tool 'Finanzamt-Brief'! Just upload your letter and the tool will give you an instant translation and explanation of the content. So you know what the Finanzamt wants you to do!

Sophia Merzbach

Sophia has been a key member of the Accountable team for many years, bringing a unique blend of journalistic precision and in-depth tax expertise to her work.

Thank you for your feedback!

Useful

How much income tax is deducted from your income is largely determined by your tax class. There are ...

Read moreWorking as a self-employed professional has many advantages: You are your own boss and you can choos...

Read moreWorking with international clients can be tricky, depending on where exactly they’re located, whet...

Read more