Understanding the Finanzamt – The Istversteuerung letter

Read in 3 minutes

You received a complicated letter written in German by the Finanzamt? No worries, after you registered as self-employed, you will get several letters, one of them is to inform you about the way you need to file VAT. In this article, we explain what information you can take from this letter step by step.

What is Istversteuerung and Sollversteuerung?

The letter you received tells you about your status concerning Istversteuerung and Sollversteuerung. You’re wondering what the hell that means? It’s actually not too complicated. The Sollversteuerung (debit taxation) is “taxation according to agreed charges”, while Istversteuerung (actual taxation) is “taxation according to received charges.”

In simplified terms, with Sollversteuerung the VAT you need to submit to the Finanzamt is already due when you issue an invoice. With Istversteuerung, the VAT is due when the money is received. The Istversteuerung is therefore more favorable for many freelancers, because you don’t have to pay VAT before you get the money from your client. However, you must meet some rules, in order to be eligible for it.

What the letter tells you

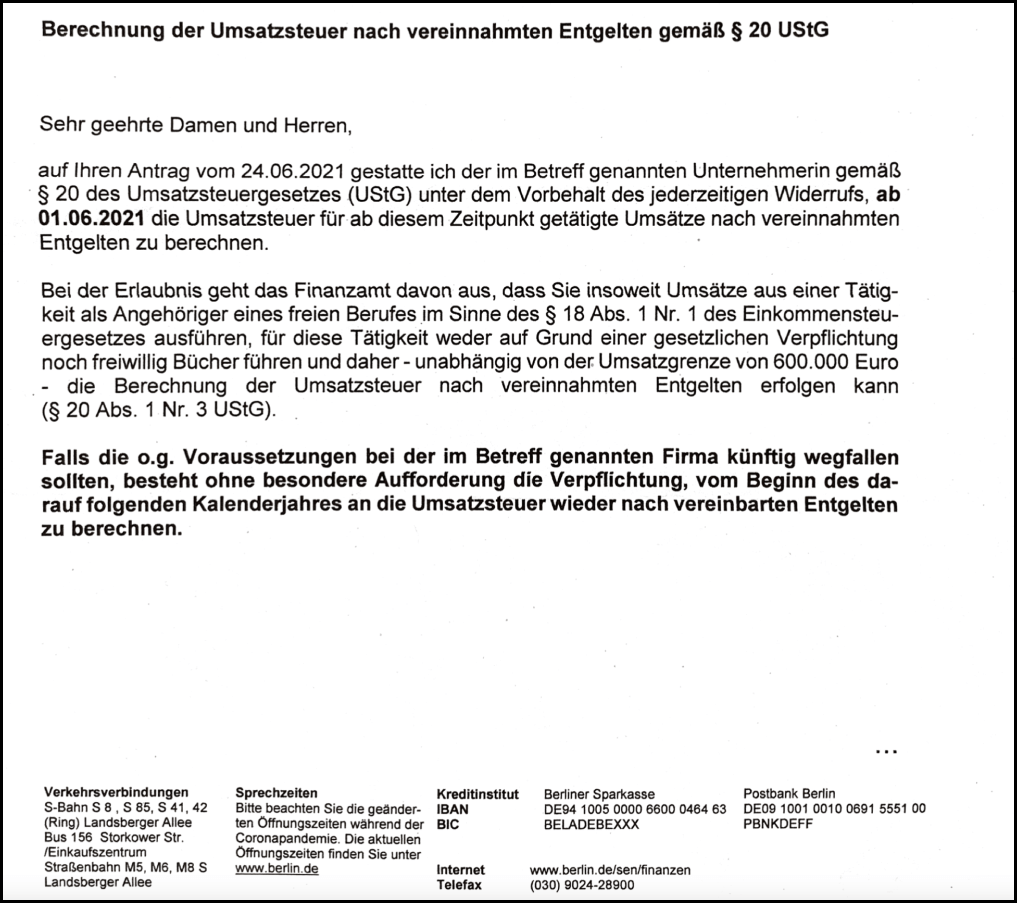

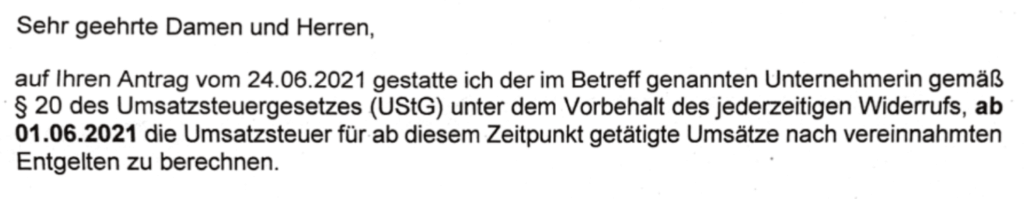

The first paragraph informs you in a typical long, German sentence, that you are allowed to make use of the Istversteuerung.

💡Tip from Accountable: You have troubles understanding the letter from the Finanzamt? Use our free AI tool to scan the letter and receive an instant summary and explanation of what you have to do! Test it now for free!

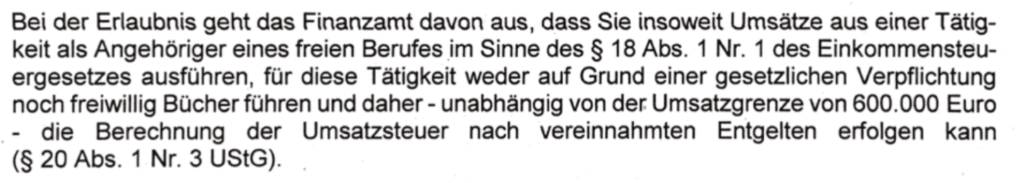

The next part explains why you are eligible for Istversteuerung, and don’t need to do Sollversteuerung. Mainly, because for your freelance-work, you will use the profit & loss statement in order to compute your profit (and not double-entry bookkeeping) and you didn’t make more than 600.000€ in the previous year.

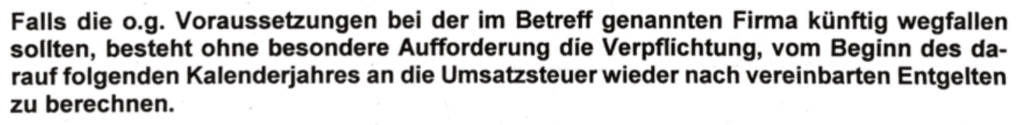

The last paragraph informs you that, should one of those rules not apply to you anymore, you need to switch to Sollversteuerung from the following year on, without any further notice.

You see, the letters that the Finanzamt sends you look kind of scary and complicated at first, but once you understand them, they hold a lot of important information about your start as a self-employed person.

Tip from Accountable💡: Accountable is a tax software and app that covers all your tax returns and bookkeeping obligations as a freelancer. Of course, we also support the Istversteuerung, so that you can submit your taxes stress-free to your Finanzamt. You can try it here for free!

Did you find what you were looking for?

Happy to hear!

Stay in the know! Leave your email to get notified about updates and our latest tips for freelancers like you.

We’re sorry to hear that.

Can you specify why this article wasn’t helpful for you?

Thank you for your response. 💜

We value your feedback and will use it to optimise our content.