How to fill out the EÜR in Elster

Read in 4 minutes

In Germany, you have to report your profits and losses as a freelancer or self-employed professional to the Finanzamt. You do that with the so called EÜR (Einnahmen-Überschuss-Rechnung). Besides other solutions, you can file your EÜR via the ELSTER platform. We show you how it works!

Who can submit an EÜR?

As a freelancer or other self-employed professional in Germany, you have to submit your tax returns for each year. This includes the income tax return, the yearly VAT return and the EÜR (profit & loss statement). All of these three mandatory tax returns you can also submit via our English language software Accountable.

There are two ways of documenting your profits: The doppelte Buchführung (double entry bookkeeping) and the much easier Einnahme-Überschuss-Rechnung (EÜR). In general, self-employed freelancers and entrepreneurs who are not required to keep double-entry bookkeeping according to §238 of the Commercial Code can submit an EÜR.

So you can use the EÜR to document and proof your profits or losses of your self-employed activity. If you have a Gewerbe (trade), you are allowed to prepare an EÜR if you make less than €600,000 in revenue per year and earn less than €60,000 in annual profit. If that’s the case, you’re exempt form the more complicated form of double entry bookkeeping.

How does the ELSTER EÜR work?

Basically, in the ELSTER EÜR, all your income as a freelancer and all your business expenses are offset against each other. The resulting difference is your profit.

Your business income includes, for example:

- Revenue from sales of goods

- Revenue from services and work performed

- Revenue from the rental of fixed assets

- Revenue from the sale of fixed assets

- Revenue from capital investments

- Commission income

- Settlements and compensation

- Revenue from operating investments

- Revenue from real estate

- Private use of motor vehicles

- Telephone

Your business expenses include, for example:

- Purchases of goods or dervices

- Repairs

- Ongoing costs

- Rent

- Payroll for employees

- Insurances

- Maintenance

- Business taxes

- Travel expenses

- Advertising costs

- Gifts for clients

- External marketing

In order to make filling out the EÜR form as easy as possible, it is advisable to organise your business account, expenses and income well throughout the tax year. Even when you don’t have revenue, for example when you just started your freelance activity this year, you can and have to prepare the EÜR. We explain how to determine the profit in this case in our blog post about the EÜR. There, we also answer these important questions:

- How does the cash flow principle work?

- How do I enter VAT in the EÜR?

What are Entnahmen und Einlagen (withdrawals and contributions)?

As the ELSTER form for the EÜR uses a lot of German tax language that is hard to translate, you will most likely stumble upon the words ‘Sachentnahmen’ and ‘Sacheinlagen’, meaning withdrawals and contributions. So what do they mean?

‘Sachentnahmen’ and ‘Sacheinlagen’ in a financial context are are transfers from or additions to your business assets. Your business assets consist of equity, fixed assets, current assets and liabilities. Your profit also counts to your business assets but doesn’t count as ‘Sacheinlage’. Examples for ‘Sachentnahmen’ and ‘Sacheinlagen’ are cash, services, or assets.

These include:

- Cash withdrawals and deposits

- Goods

- Products

- Services

‘Sachentnahmen’, meaning withdrawals, is when you withdraws cash, assets, or services from your business assets for your personal use. The other way around, ‘Sacheinlagen’, meaning contributions, you transfer cash or assets from your private use into your business assets.

Entnahmen and Einlagen for freelancers

Especially for freelancers, the withdrawal from business assets for livelihood is significant. Since freelancers do not pay themselves a salary in their freelance work, they have to compensate for their expenses through private withdrawals from business assets.

If you instead want to invest your personal money or assets into your business, you can increase the business assets with your contributions. Your total business assets are not taxed; only your profit is. However, ongoing revenues from business assets, such as income from capital investments, must be taxed with business income. In return, you can deduct ongoing expenses from business assets, such as maintenance costs, from business expenses. For these reasons, your withdrawals and contributions throughout the financial year are also queried in the EÜR.

Calculate the EÜR without income

You have to submit an EÜR, even if you don’t made any profits as a freelancers or Gewerbe (trade). There is no separate form or declaration for this. You as the taxpayer simply don’t enter any income in the EÜR in ELSTER. Since the fields of the form must not remain empty, the value 0 must be entered.

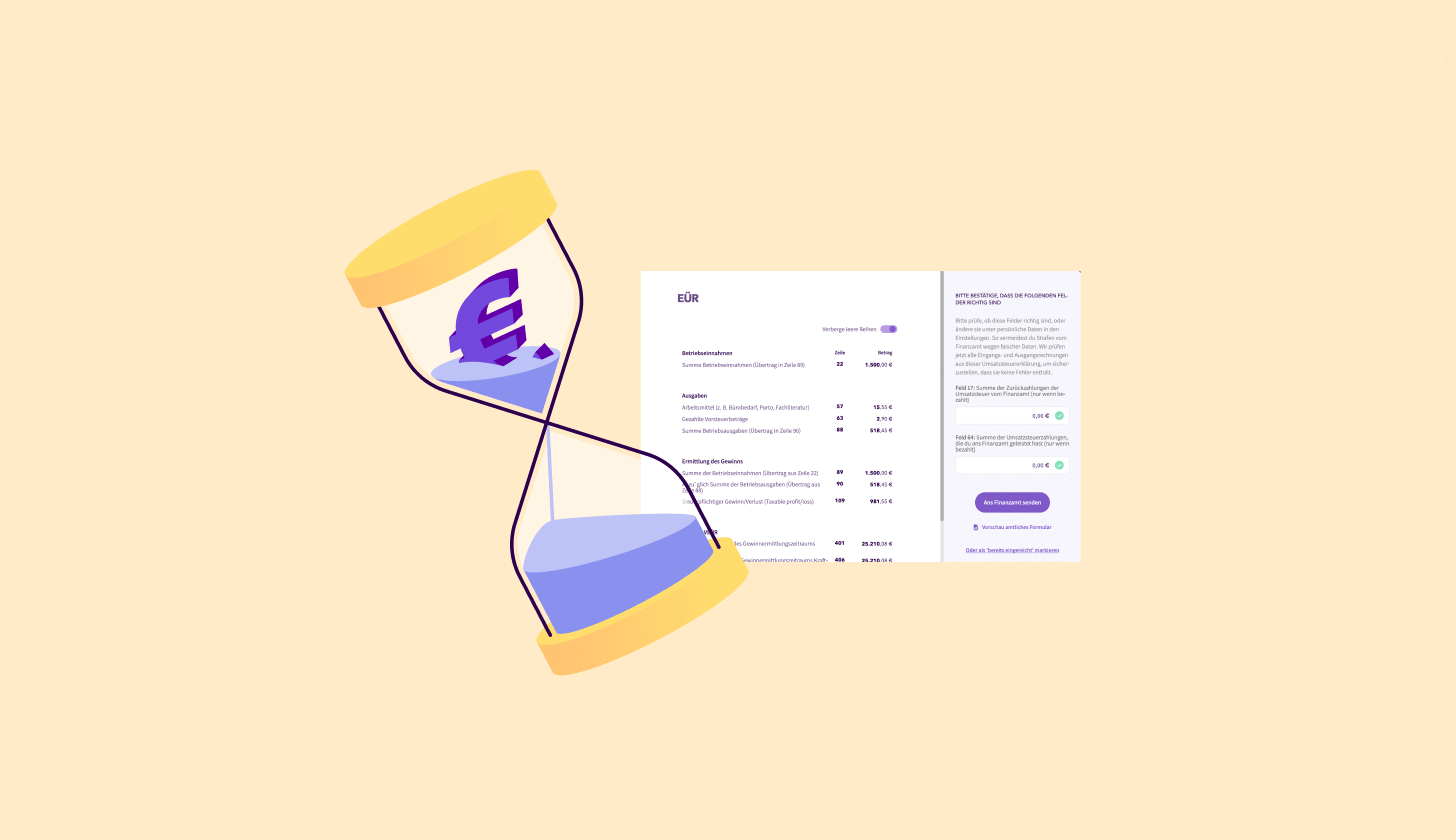

How to do the EÜR in ELSTER

You can easily submit the EÜR digitally via ELSTER. The standardised form is available on the homepage of MeinElster. Under the tab ‘Formulare und Leistungen’, you will find the menu item ‘Alle Formulare’. Here you will find the link to the EÜR.

Depending on your personal situation, additional attachments may be required for the EÜR calculation:

- AVEÜR: Anlagevermögen (fixed assets)

- Anlage SZ: nicht abziehbare Schuldzinsen (non-deductible interest expenses)

- Anlage SE: Sondergewinnermittlung (special profit determination)

- Anlage AVSE: Anlagenverzeichnis zur Anlage SE (special business assets)

- Anlage ER: Ergänzungsrechnung (supplementary calculation)

- Anlage LuF: Profit determination from agriculture and forestry

You can also fill in these additional attachments in ELSTER after completing the main EÜR form. If the Finanzamt requires you to submit one of these forms, you will also be informed via letter.

💡Do you need help with filling out the EÜR? You can find a detailed description and comprehensive assistance for the EÜR here. There is no specific example for filling out the EÜR because every tax declaration is individual.

If rightfully, you think the ELSTER form is a bit too complicated, you can also submit your EÜR via Accountable! Test it now for free!

Did you find what you were looking for?

Happy to hear!

Stay in the know! Leave your email to get notified about updates and our latest tips for freelancers like you.

We’re sorry to hear that.

Can you specify why this article wasn’t helpful for you?

Thank you for your response. 💜

We value your feedback and will use it to optimise our content.