If your home is the hub of your whole professional activity, expenses incurred maintaining an office at home are fully deductible. By deducting home office expenditures as business expenses, you may minimize your taxable income and reach a smaller tax burden.

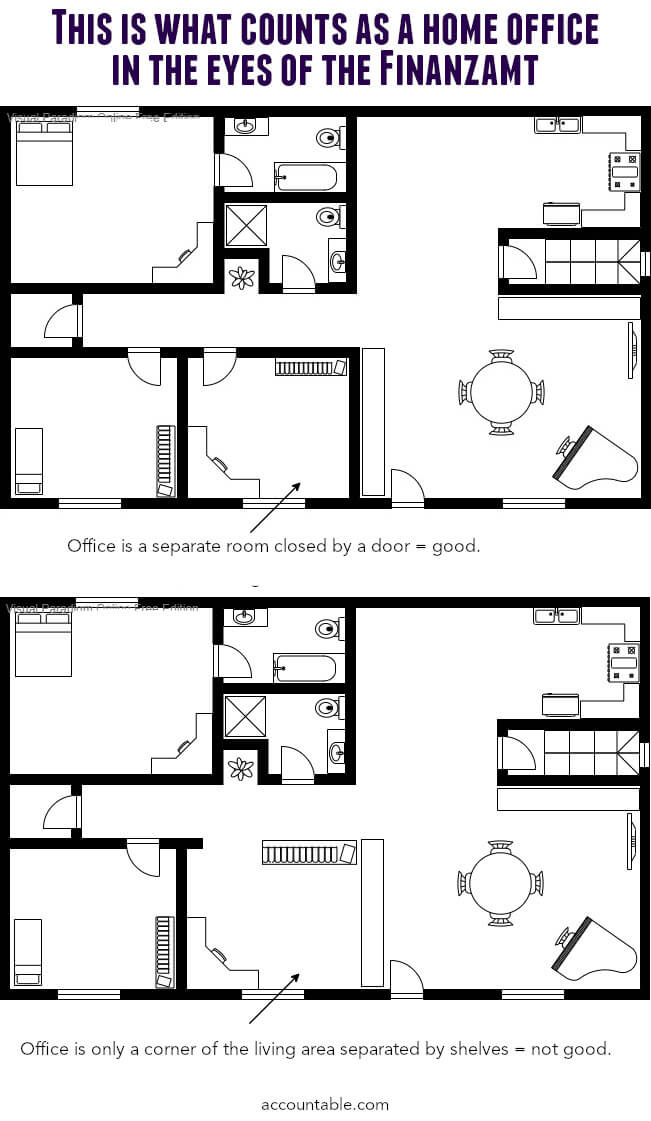

Various professional and spatial conditions must be met in order to be able to deduct the costs of an office at home.

The Finanzamt can check if those requirements are met by sending in a questionnaire, so you can certify you fulfill all of them.

You can deduct those expenses as part of your home office expenses:

For most of those, you will need to divide these pro rata - according to the area of your home office to the total living area (including home office space). This means that if you live in a 100sqm home and your home office is 10sqm, you can deduct 10% of the expense (e.g: rent)

Don't forget to include the costs of furnishing your office, such as shelves, a desk, or an office chair, as business-related expenses. These expenses are fully deductible too. The only condition is that you use these items almost exclusively for professional or business purposes. You can immediately deduct items up to 952 euros (VAT included). Anything above that amount, you will need to depreciate them over several years (Abschreibung).

For self-employed persons, those costs are assigned as business expenses. You will assign them to “Betriebsausgaben” in the form “Anlage S”.

Keeping track of those expenses can be tricky. Thankfully, using an app like Accountable makes it easy. You are sure to assign those expenses in the right categories, making your life much easier when it comes to doing your tax return yourself, or with a Steuerberater.

You can find a detailed guide on deductible expenses for your tax return in Germany here.

20 Kapitel knallhart recherchiert und vom Steuerprofi geprüft

Kostenlos herunterladen

Author - Sophia Merzbach

Sophia has been a key member of the Accountable team for many years, bringing a unique blend of journalistic precision and in-depth tax expertise to her work.

Who is Sophia ?Thank you for your feedback!

Useful

How much income tax is deducted from your income is largely determined by your tax class. There are ...

Read moreWorking as a self-employed professional has many advantages: You are your own boss and you can choos...

Read moreWorking with international clients can be tricky, depending on where exactly they’re located, whet...

Read moreSehr angenehmes Entgegenkommen der Mitarbeiterin. Sehr nett fand ich auch, dass die Kommegin sich direkt bei Problemlösung nochmal bei mir gemeldet hat.

Steffen Wege

Was Accountable für mich so besonders macht, ist der überragende Kundenservice. Ich habe bereits mit einigen Mitarbeitern zu tun gehabt und war jedes Mal aufs Neue sehr glücklich mit der Freundlichkeit und Professionalität, mit der ich begleitet wurde. Ich fühle mich verstanden und wertgeschätzt, das ist etwas besonderes in unserer heutigen Welt. Ein großes Dankeschön 🌟

Thomas Kaiser

Accountable ist ein intuitives Tool, mit dem Buchhaltung und Steuererklärung unproblematisch erstellt werden können-

Anonym

Freundlicher Kontakt mit Wissensvermittlung und verständliche Mitteilung. Top!

Anonym

Ich mache gerade eine tolle Erfahrung mit euch.Danke für eure Unterstützung

Sandro Antonio Sansiveri

Danke ich für meinen Teil bin noch am Anfang

Anonym

Very professional, responsive, and always available to clarify my questions. The guidance was clear and practical.

Jobe Michael

Für mich als Kleinunternehmer ist der Preis ein bisschen hoch, aber für alles, was ich bekomme: alle Übersichten von Einnahmen und Ausgaben, die Funktionen rund um das Auto... ist es einfach top. Und das letzte Update zu den wiederkehrenden Ausgaben war hervorragend! Dankeschön.

Ardalan Zamanimehr

Die App ist super! Intuitiv und perfekt für Selbstständige. Leider ist meine Position noch zu exotisch für Accountable um genau diese Leichtigkeit auch in Anspruch zu nehmen. Es gibt noch keine einfache Lösung für Selbstständige mit zwei Steuernummern da zwei Berufe. Sollte sich das mal ändern, Wechsel ich von meinem Steuerberater wieder zu Accountable!

Viktor Rosin

Sehr freundlich und gezielte , verständliche Angaben und Erklärungen

Pascal Koopmann