Your questions

Your questions Tax Declaration

Tax Declaration Dedicated tax

Dedicated taxHear it straight from our users

The tax regulations in Germany are pretty complex. Luckily Accountable makes the process of doing taxes worry-free and downright pleasant. What I really like is that they give you a guarantee that using their app will not get you into any trouble. That means they really stand behind their product, and I applaud that.

Extremely helpful as a foreign freelancer in Germany, would be lost without it. Any questions i ever have are also answered quickly and informatively by staff too.

Really nice app that has all that I want as a small business ( freelancer ). Simon on customer service was spot on

It’s intuitive and easy to use and all my administration is in one place. Next to that, the app actually gives you tax saving tips, just with those I’ve saved the more money then the app cost me!

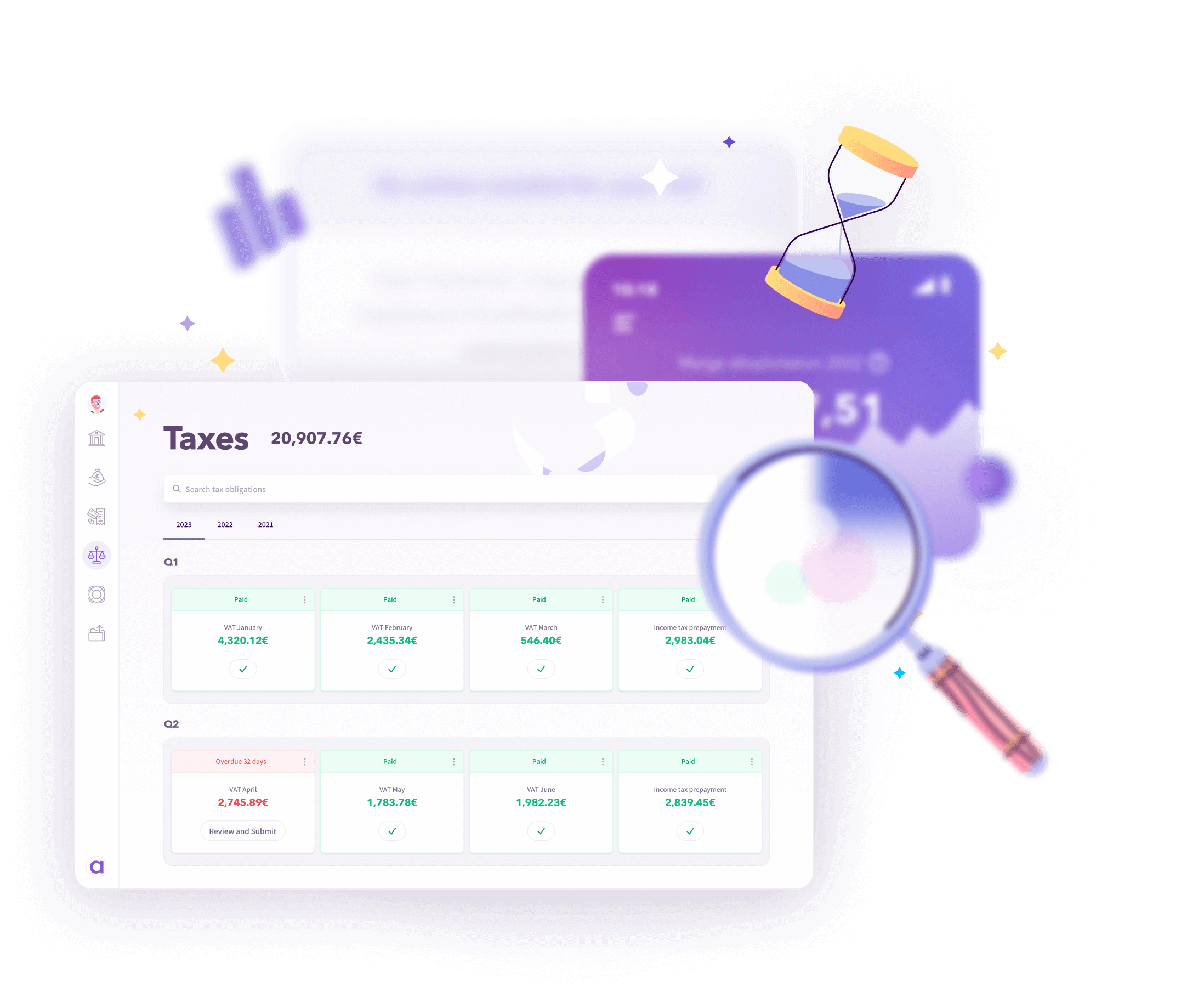

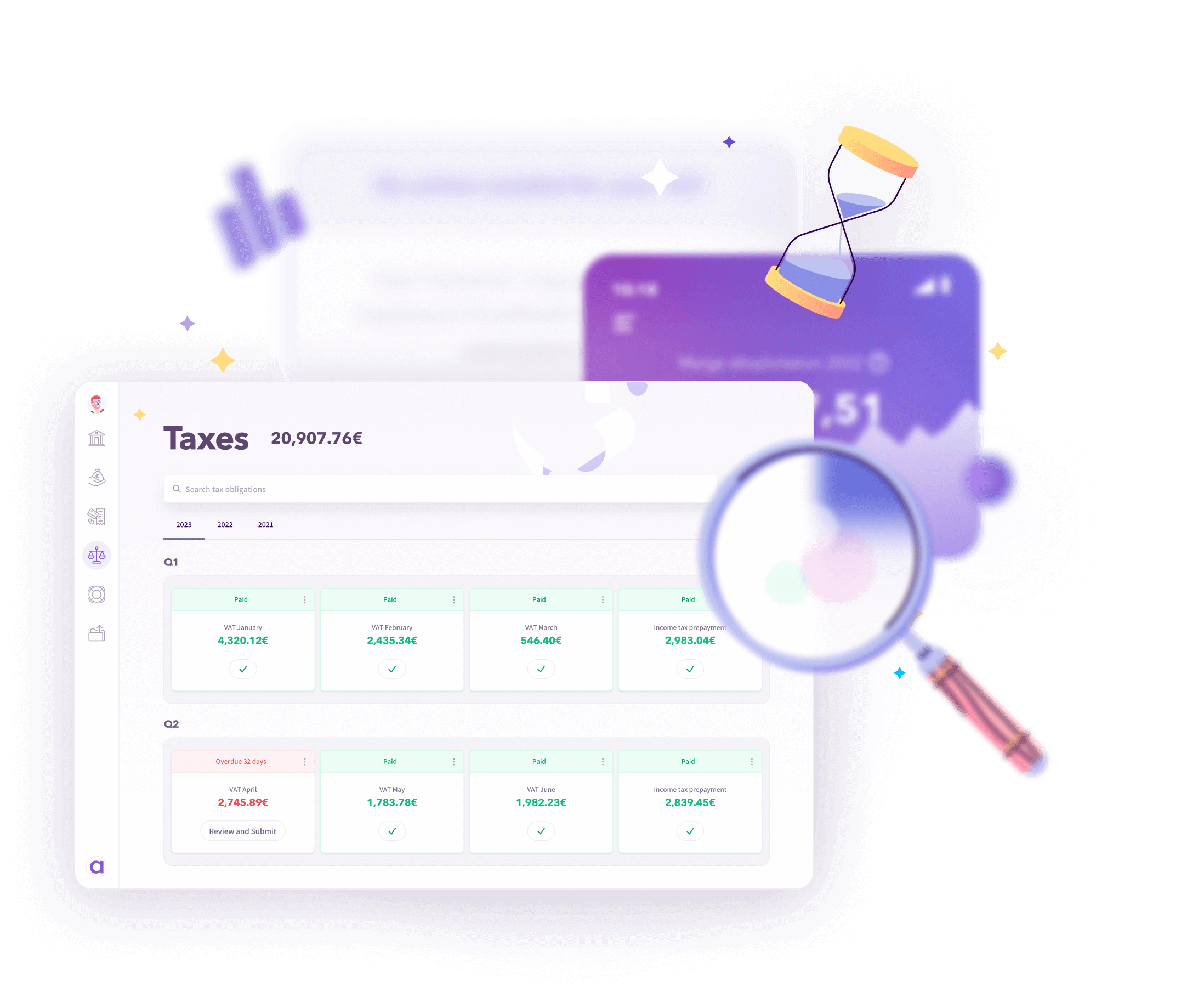

File VAT, income tax, trade tax and profit & loss statement without knowledge of German taxes

File VAT, income tax, trade tax and profit & loss statement without knowledge of German taxes  Send tax returns directly to the Finanzamt, no tax advisor needed

Send tax returns directly to the Finanzamt, no tax advisor needed  Get reminders for upcoming deadlines and tax tips

Get reminders for upcoming deadlines and tax tips

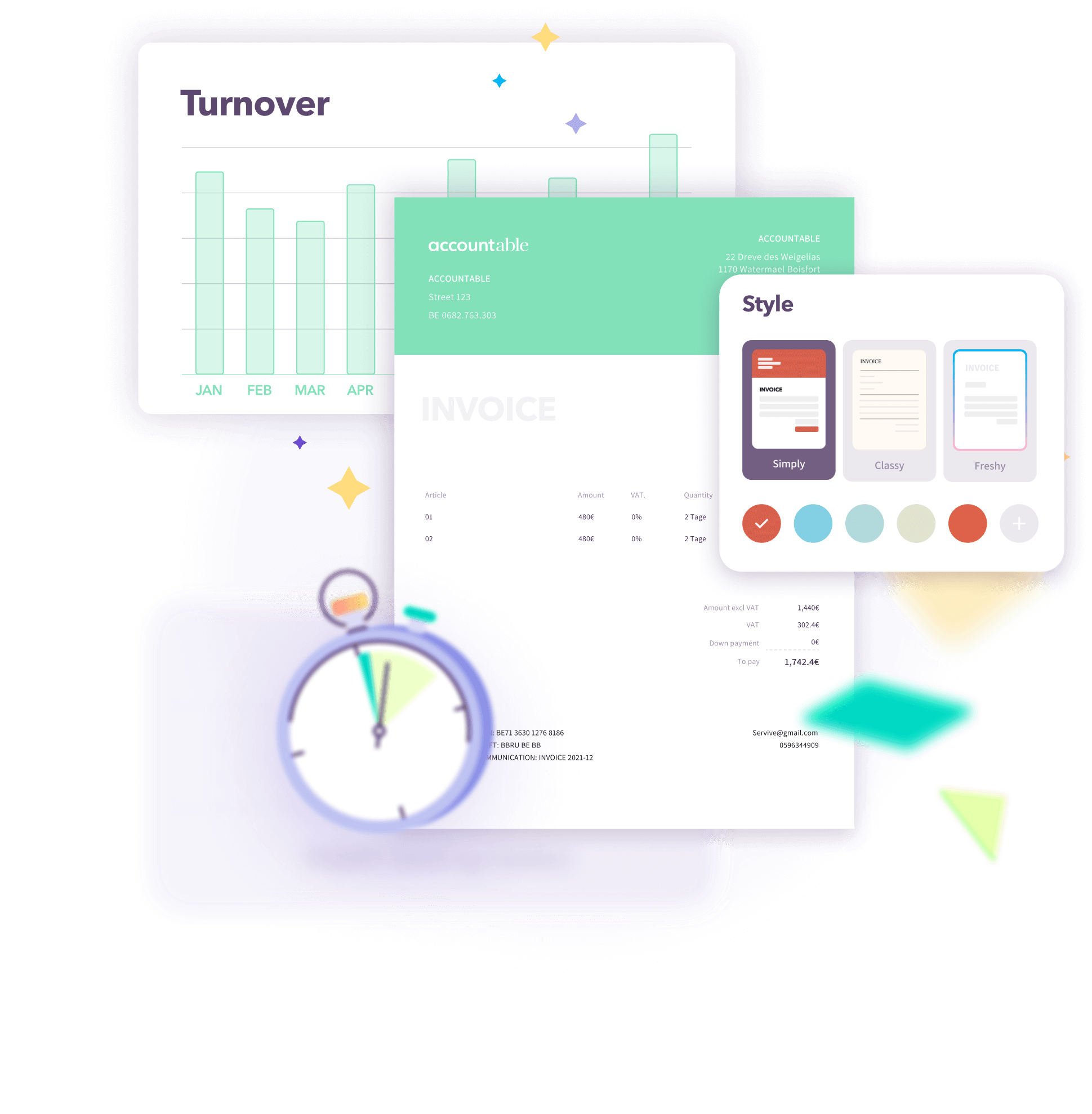

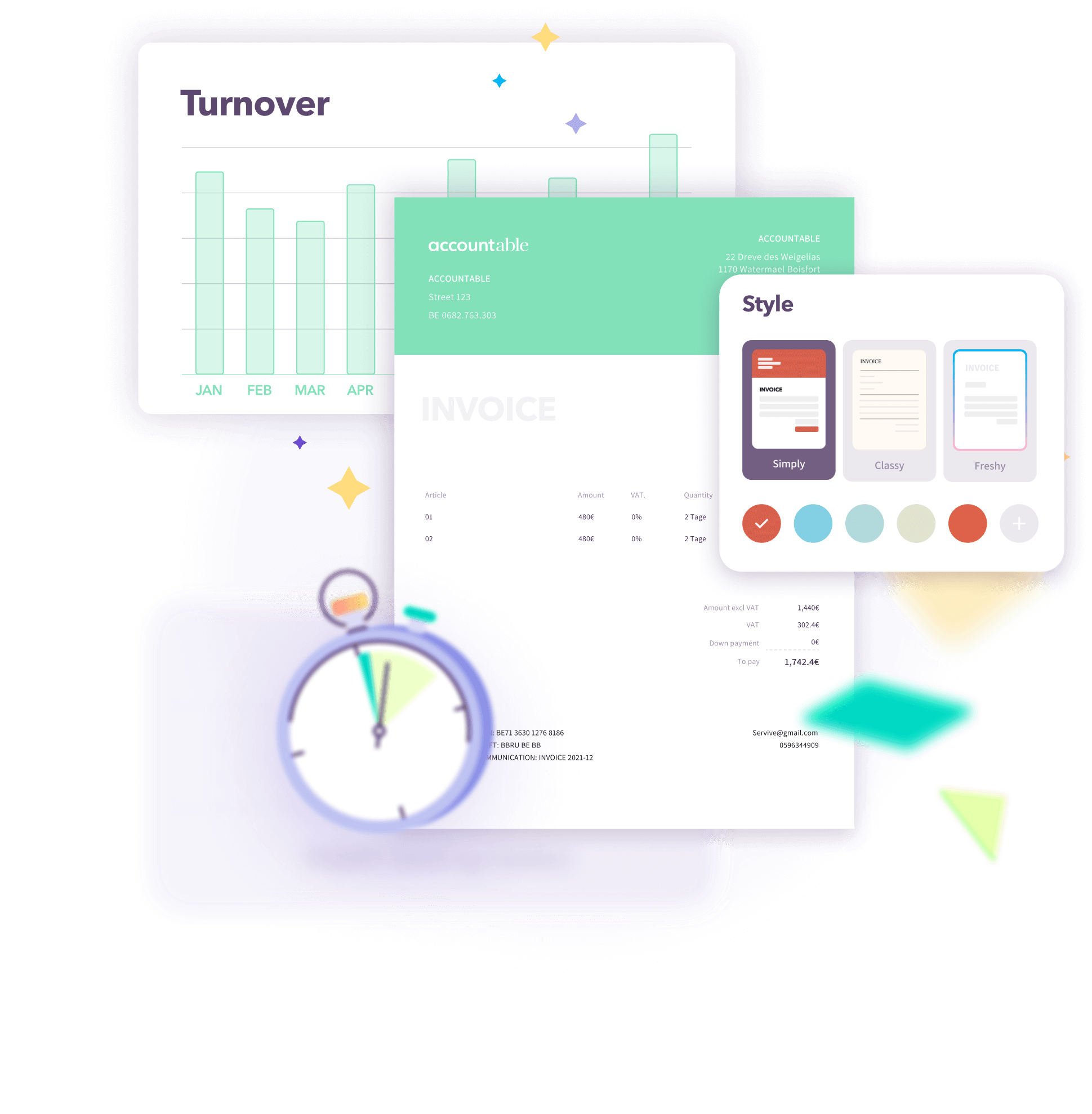

Send e-invoices as XRechnung or via Peppol

Send e-invoices as XRechnung or via Peppol  Federally compliant templates

Federally compliant templates  Invoice customers abroad in any currency

Invoice customers abroad in any currency

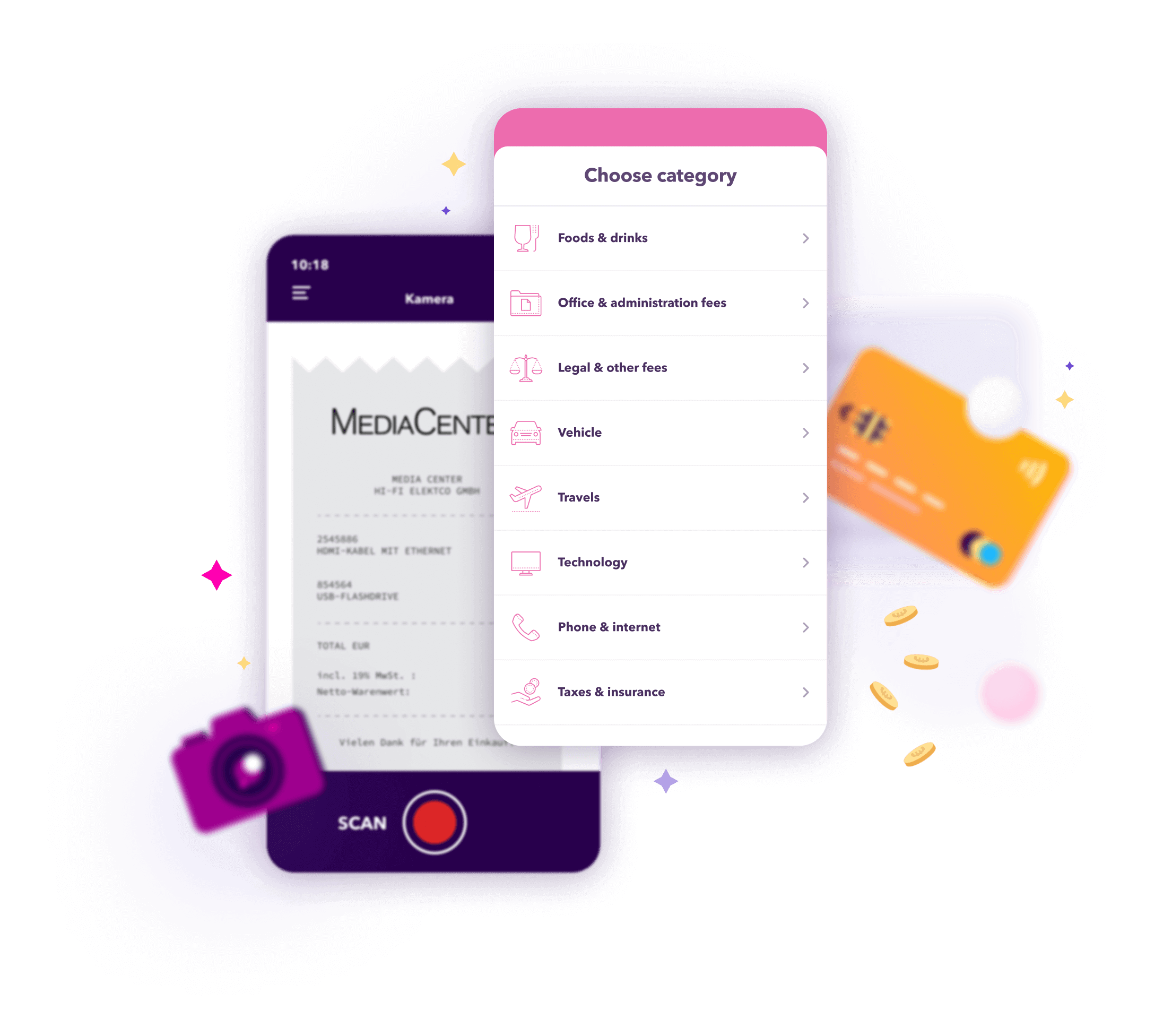

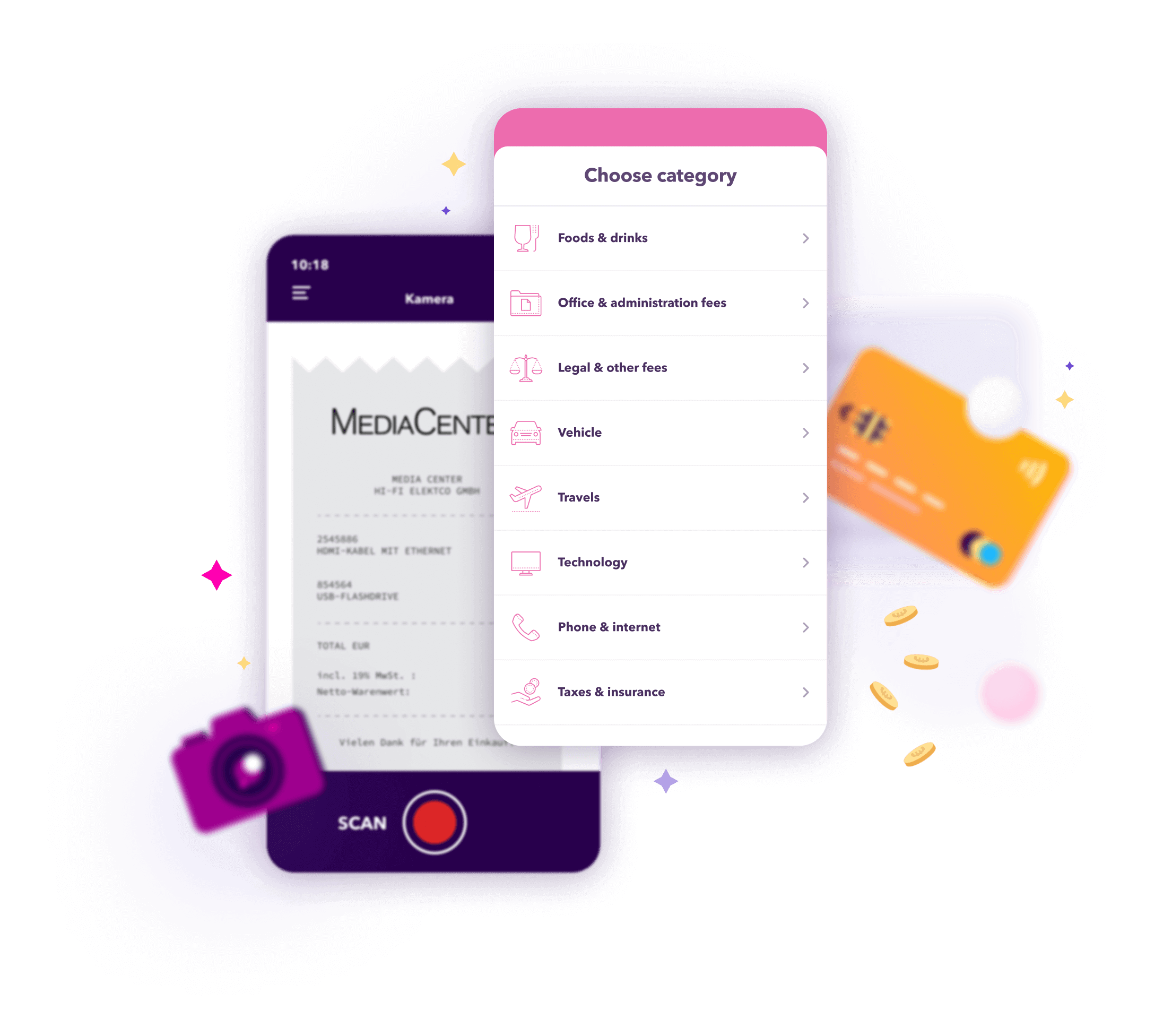

Scan your receipts easily on-the-go

Scan your receipts easily on-the-go  Tax tips to maximise expenses

Tax tips to maximise expenses  Expenses are automatically linked to bank transactions

Expenses are automatically linked to bank transactions

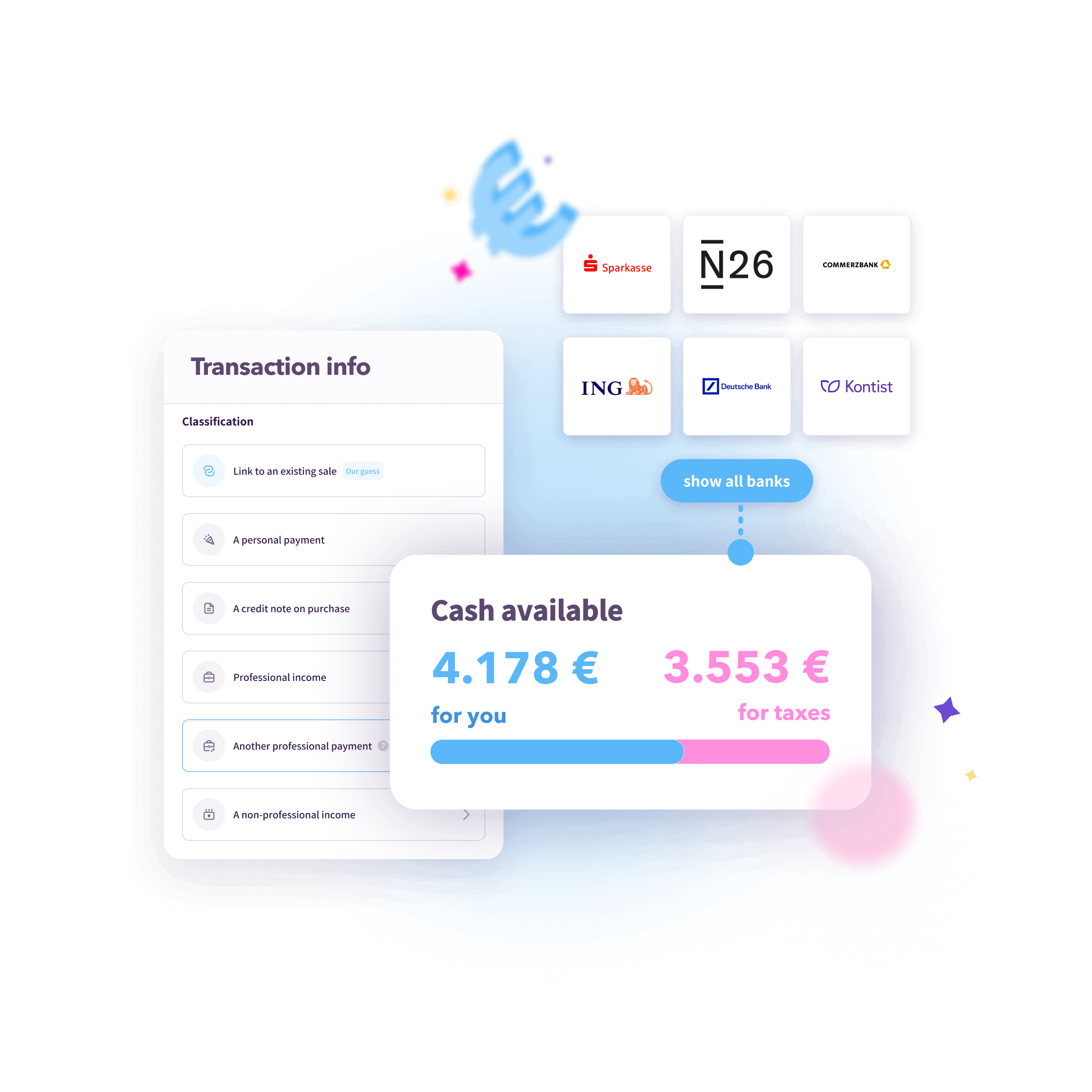

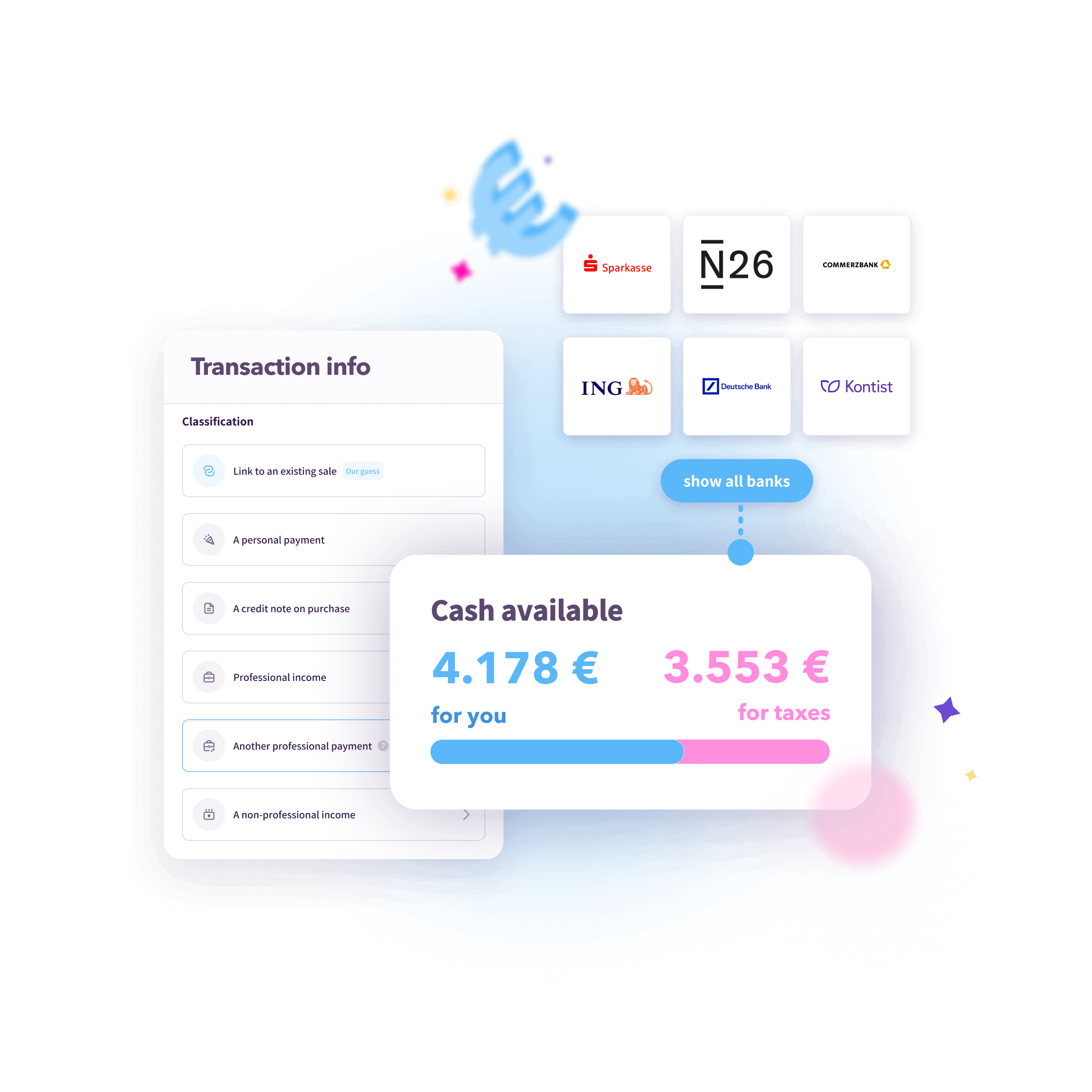

Keep your bookkeeping always up to date in the app and on the desktop

Keep your bookkeeping always up to date in the app and on the desktop  Get notified when a client pays you

Get notified when a client pays you  Bank account connection and credit card statements

Bank account connection and credit card statements

Choose our FREE plan for your invoicing or discover our gain full indpendence starting from €15.50 / month.

€0

Free for everyone

€9,25

For Kleinunternehmer with less than €22.000 revenue per year

€16,75

For Gewerbetreibende and Freelancer that charge VAT

We developed Accountable together with a team of experienced tax advisors. This way we

guarantee you full control and security over your tax obligations.

Markus Thomas Boldt

Tax and law office Boldt Diplom-

Finanzwirt (FH)

Andreas Reichert

Fischer & Reimann

Steuerberatungsgesellschaft mbH,

Leitung der Niederlassung Berlin

Maximilian Schott

Steuerberater

Master of Taxation (M.Tax)

Steuerkanzlei Alfred Schott

You would like additional professional advice? Book an

appointment with one of our partner tax advisors.

The unique advantage is that in addition to bookkeeping, you can also do your private tax return with Accountable. This way, you always have your invoices, expenses, profit and taxes under control.

In addition, you benefit from the Accountable tax guarantee: In the event of errors due to the Accountable app, we will refund any resulting back taxes up to €5,000.

You have all this in the web version on your desktop or on-the-go in the app at any time.

Yes, Accountable is particularly suitable for Freiberufler (freelancers), you have everything you need for bookkeeping and taxes in one tool. Whether you want to scan the invoice from your coffee with your client on the go, send your customised invoice at the end of the day, or submit your VAT return on time and without much effort - with Accountable you save money and time.

Yes, because you can also find your Gewerbesteuererklärung (business tax return) directly with us - a service that no one else offers.

Accountable adapts to your individual tax situation and helps you save tax

Yes, we have developed Accountable specifically for the self-employed and Kleinunternehmer (small business owners). Our SMALL plan offers all the features you need as a Kleinunternehmer: you can prepare your annual income tax return, create correct Kleinunternehmer invoices and scan and save your expenses. In SMALL, you're also covered by our tax guarantee. You get all this for €15,50 a month.

Accountable automatically adjusts to your individual tax situation. If your business is doing better than expected and you want to switch to standard taxation, you can easily change this in your account and the settings will adapt to your new situation.

Currently, Accountable is optimised for freelancers and trade persons. For example, our software supports the profit & loss statement (EÜR) for easy profit determination. Feel free to contact us via chat or email ([email protected]) if you have further questions. We work with certified tax advisors who can offer you further support.

If you use Accountable, you usually don't need any further tax advisor or accountant. Because our solution offers you all the functions you need to manage your accounting and taxes independently - even without prior tax knowledge.

With our tax guarantee, you are additionally protected, because our AI-based software ensures that you do not make any mistakes. If there is a mistake due to the Accountable app, we'll refund any resulting back taxes up to €5,000!

Of course, Accountable gives you the freedom to decide how you want to work. If you like to work with a tax advisor, you can simply invite them to Accountable and they will have access to your account via the personal tax advisor access. You can also export all data in DATEV format if required.

With its PSD2 license, Accountable is under the supervision of the Federal Financial Supervisory Authority (BaFin) in Bonn (Directive (EU) 2015/2366) and has the strictest security procedures to protect your data. We are regularly audited and have strict reporting requirements. We use recognized security standards (256-bit SSL certificate) to encrypt your confidential data.

Without the trust of our users, Accountable cannot succeed. We do everything to protect the data and security of our users.

You can test the full functionality of Accountable for the first 14 days (no payment required). After that, you can continue to use the Accountable app free of charge for as long as you like.

The free version gives you access to up to 5 documents. You can either write invoices or scan expenses. There are no costs and you don't have to sign up for a subscription.

If you want unlimited use of all Accountable features, you can switch to our PRO or SMALL plan (for Kleinunternehmer). This gives you the possibility to do your tax returns and VAT returns. In addition, in PRO you can not only access the app but also edit everything on your laptop in the web version.

Accountable PRO costs €33,50 per month (monthly subscription) or €22,50 per month (annual subscription).

Accountable SMALL is made for all self-employed people who benefit from the Kleinunternehmer regulation (< 22.000€ turnover). Just like Accountable PRO, with SMALL you can file all your tax returns and do all your bookkeeping from your desktop or smartphone. SMALL costs €18,50 per month (monthly subscription) or €15,50 per month (yearly subscription).

You can read more about our pricing here.

The AI Tax Advisor supports you with your taxes and answers all your questions about taxes, bookkeeping and self-employment.

This is because the unique AI is specialised in German tax rules and can also take your personal situation as a self-employed person into account in its answers.

That's what the AI Tax

Advisor can do for you:

- It ensures simple and error-free tax returns

- It answers all your tax questions

- It takes the stress out of taxes and the fear of the Finanzamt

The Accountable AI Tax Advisor gives you personalised tax tips so that you can meet all your tax obligations without errors and have every possible question answered. Not only can the AI talk to you, it can also do things for you. For example, your details are automatically checked for errors. So you can be sure that your tax return is correct.

How do we do it?

1. We have trained our AI with the latest tax information from tax law, practical tips from our tax advisors and our own huge database of tax knowledge, making it a unique AI expert for self-employed people in Germany.

2. Our AI Tax

Advisor automatically checks and validates the data you enter so that everything is correct and meets the requirements of the Finanzamt.

3. Another unique feature is that you receive specific individual tips tailored to your situation. For example, you can now ask: "What haven't I deducted so far?", "The tax office has sent me this letter, what exactly do I need to do?", or "How much money do I need to set aside for taxes?"

What about privacy and control? This is of course particularly important to us. That's why you decide at any time what information you share with your AI Tax Advisor.

Yes, with Accountable, you can easily receive and send e-invoices, including formats XRechnung and Peppol, that meet official standards. Our platform ensures your invoices are compliant, professional, and ready for seamless digital processing. Simply create, send, and manage all your e-invoices in one place. And the best part - it's completely free and unlimited also in our FREE plan!